Overheads to be cut by as much as 50% as EU green-lights Indian takeover of KTM parent company

It’s been a year since the depth of KTM’s financial problems came to light sparking months of uncertainty for the Austrian brand before an insolvency court approved a rescue deal that involved creditors accepting a 70% loss on what they were owed.

Under that arrangement, KTM had a strict deadline to pay the remaining 30% of its debts, and needed a financial injection that came in the form of €800 million in the form of a loan from existing minority shareholder Bajaj. The understanding was that, given approval by the relevant government oversight bodies, that loan would be converted to a shareholding, giving Bajaj a controlling stake in KTM, and now that approval has arrived.

KTM is part of a complex corporate structure. It’s wholly owned by Pierer Mobility AG, which itself is owned by Pierer Bajaj AG, a company that’s until now was split so 50.1% of the shares were owned by Pierer Industrie AG and the remaining 49.9% by Bajaj Auto International Holdings BV, the European arm of Indian brand Bajaj Auto. Under the bailout, that €800 financial package came from Bajaj International Holdings, and both Austrian merger authorities and the European Commission have now green-lit the conversion of that loan into an acquisition of all 50,100 shares in Pierer Bajaj AG that were previously owned by Pierer Industrie AG, giving Bajaj complete ownership of Pierer Bajaj AG. In turn that means Bajaj owns Pierer Mobility AG – which it has already announced will be renamed Bajaj Mobility AG – and, in turn, KTM, Husqvarna and GasGas.

It’s expected to spark a set of in-depth measures to slash KTM’s costs, with changes to staffing, R&D, racing and production as Bajaj takes action to turn around the company’s fortunes. In an interview with India’s CNBC-TV18 financial TV channel in October, Bajaj managing director Rajiv Bajaj explained both the root of KTM’s problems and his intentions to fix the issue.

He blamed the company’s issues on corporate greed: expanding too fast and into the wrong segments on the heels of the brief upturn that followed the COVID-19 pandemic. Under his analysis, that resulted in overproduction, with unsold bikes equivalent to more than a year’s worth of inventory languishing in dealers and the supply chain, and strategic missteps including the expansion into the electric bicycle business.

KTM’s costs are also too high. He said: “From the outside, so far what we observe is that there is an opportunity to reduce the overheads by more than 50%. That covers R&D, that covers all marketing areas including racing. That covers all the operational areas.”

Staff levels are also in the spotlight, despite KTM slashing its numbers from 6,000 to 4,000 over the last year. In his interview, Bajaj said: “In this 4000 people, only about 1000 people are blue-collar. 3000 people are white-collar and that’s really perplexing, because it’s the blue-collar that make the motorcycles…”

He continued: “The issue is going to be with the white-collar headcount, which is very expensive.”

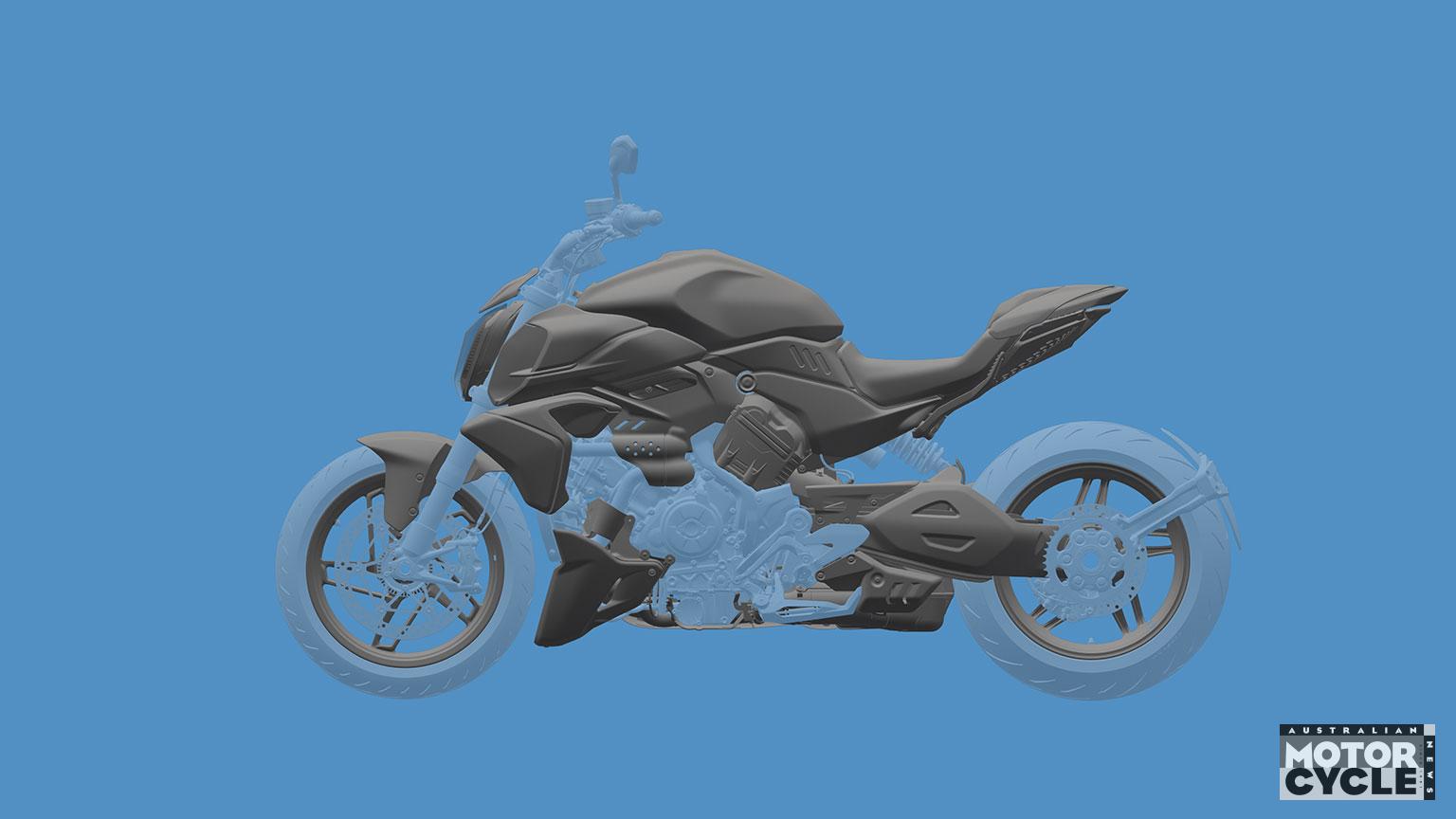

In terms of manufacturing, Bajaj has previously expressed an interest in shifting more production to India, where KTM’s smaller single-cylinder bikes like the 125, 250 and 390 Duke models are already made. The company also makes parallel twin in China under its joint venture with CFMoto. In future, KTM’s two-cylinder machines could also be made in India. Rajiv Bajaj pointed to Triumph’s successful strategy, which has seen UK manufacturing largely shifted abroad with the vast majority of modern Triumphs made in its three Thai factories or, in the case of the 400cc singles, in India under its own partnership with Bajaj.