Potential investors are circling but the clock is ticking to seal a deal

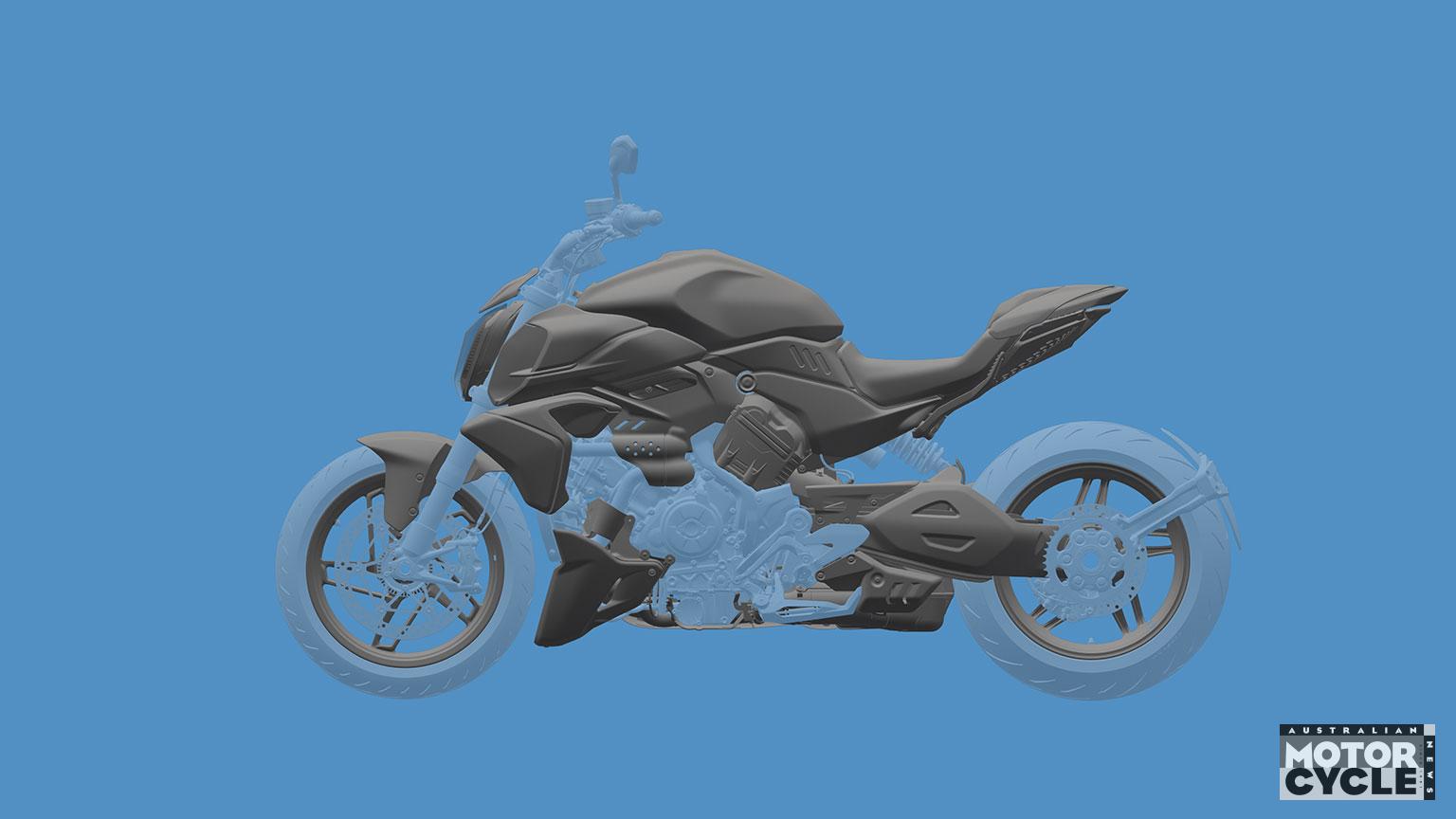

Rarely have we seen such an abrupt reversal of fortunes. As Europe’s largest bikemaker, KTM was riding the crest of a wave a couple of years ago but entered self-administration in November to gain protection from creditors as high investment and borrowing clashed with declining sales.

Austrian financial laws gave the company 90 days to get a restructuring plan approved by a majority of its creditors. That plan has now been presented and, according to Austrian journalists, asks creditors to accept 30 percent of what they’re owed, payable within two years, to allow KTM to continue. If they don’t and KTM goes into liquidation, the sale of assets is expected to recover less than 22 percent.

Outside investment is key, with three potential saviours identified so far. The first two are KTM’s existing manufacturing partners, Bajaj in India – which already holds a 37 percent stake in KTM’s parent group, Pierer Mobility – and China’s CFMoto, which operates a joint manufacturing venture with KTM in China as well as relying on KTM for the distribution of its own bikes in Europe and America. The third potential investor is Hong Kong-based Fountainvest, a private investment company.

KTM AG is one of three troubled companies in the Pierer Mobility stable, the others being its subsidiaries KTM Forschungs & Entwicklungs GmbH, the research and development arm, and KTM Components GmbH, which manufactures some parts. KTM AG makes up by far the largest proportion of the overall debt, believed to be €1.8 billion ($A3b), suggesting that even to achieve a 30 percent payout, KTM must raise €540m ($A750m). It’s been claimed the three companies’ liabilities are as high as €2.9 billion ($A4.8b).

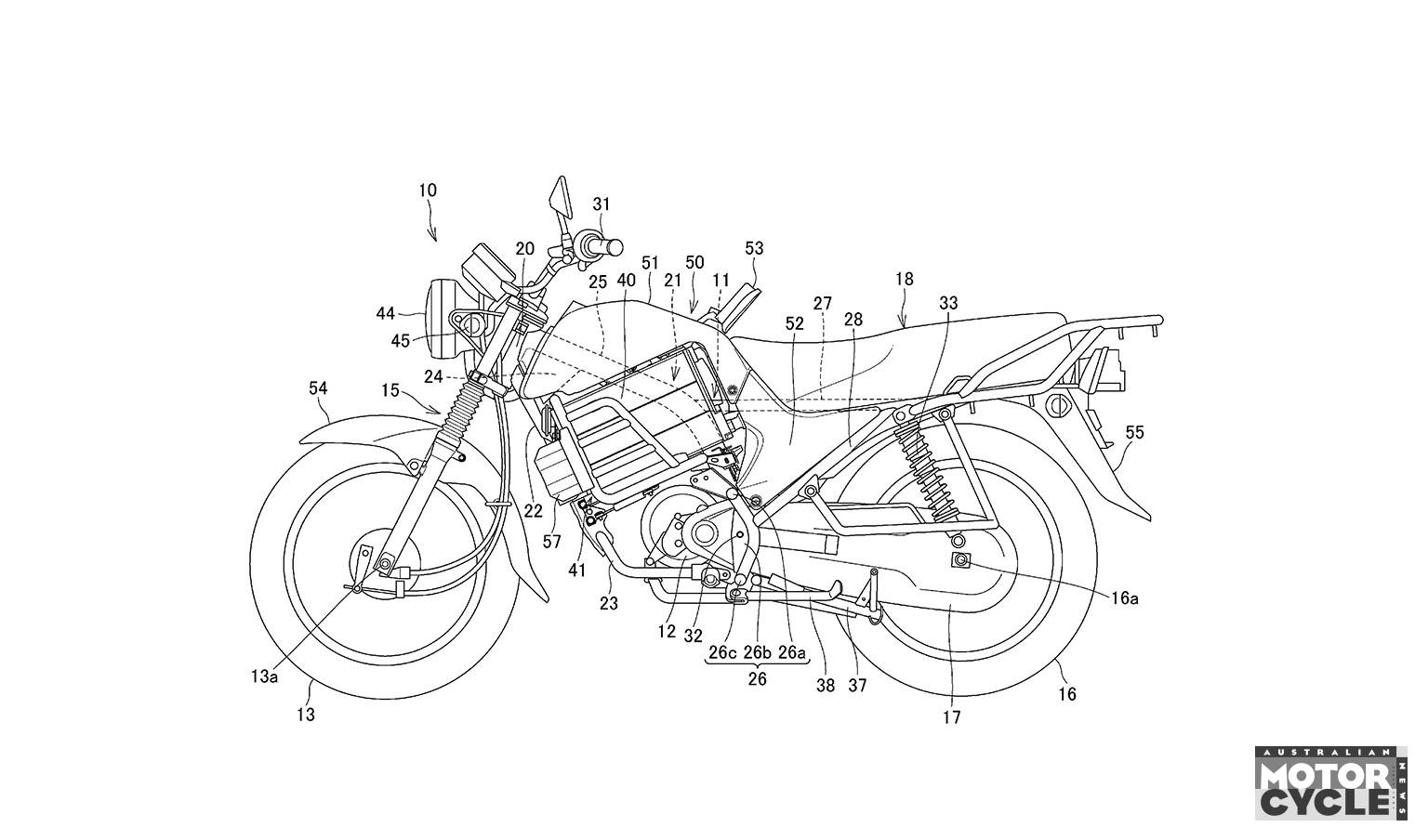

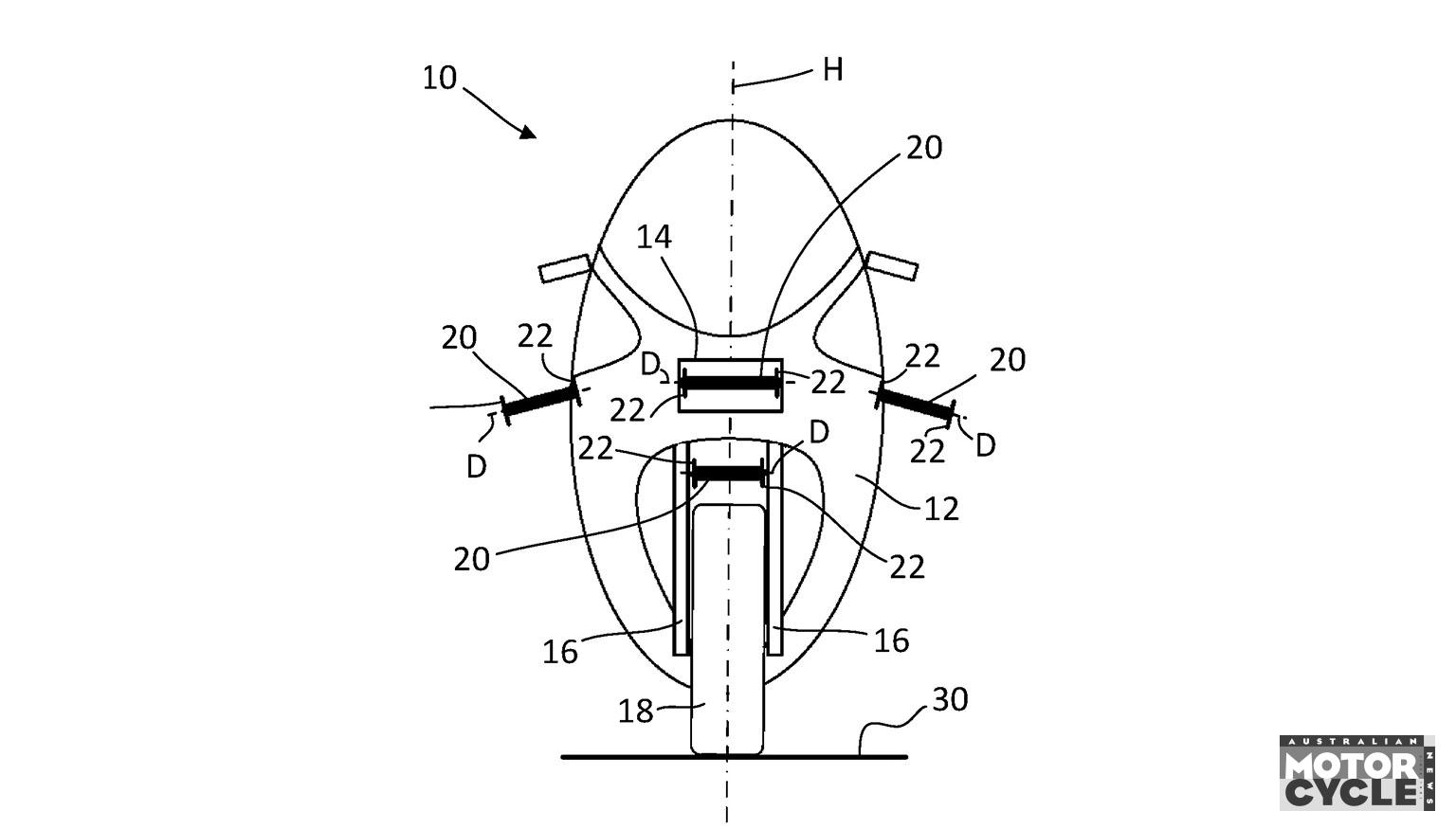

Bajaj – which manufactures the ‘390’ single-cylinder bikes on KTM’s behalf – is believed to be prepared to put €300m on the table, while CFMoto, which makes the ‘790’ LC8c-powered twin-cylinder bikes and uses the same engine in its 800MT and 800NK models, is said to be ready to put in between €350m and €700m.

It’s likely KTM will be able to secure enough money to survive, provided its creditors agree to the restructuring plan. The third week of January is believed to be pivotal, when binding offers of investment need to be on the table to allow the restructuring to proceed.

Restructuring administrator Peter Vogl presented his report at a court on December 20, where the judge decided the company could continue to operate until the creditors’ decision on the plan is made in February. At that presentation, Vogl explained how KTM reached its current situation. With demand outstripping supply in the wake of the Covid pandemic, it increased production and sales, but when demand decreased production wasn’t, leading to excess unsold inventory. Some news reports has the total number as high as 265,000 motorcycles.

Turning to KTM’s immediate future, the respected Austrian newspaper Der Standard reports that 391 employees in Austria will be laid off in January and February, with much of the remaining workforce reducing their hours during the same period. Production is on hold and not expected to resume until February or even March as KTM works to bring down its stock of unsold bikes.

What does KTM’s restructuring mean for core businesses and racing activities?

Web of subsidiaries needs to be untangled

KTM is just part of the wider Pierer Mobility AG group, which also holds brands including Husqvarna and Gas Gas and suspension maker WP, as well a 50.1 percent stake in MV Agusta, 50 percent of design agency KISKA and an array of subsidiaries within those brands.

Inevitably, there’s discussion as to which brands should be retained, and already it seems that MV Agusta is back on the market. Being largely independent of KTM in terms of the components it uses, it could be sold relatively easily. Husqvarna and Gas Gas’s machines are deeply connected to the KTM model range, sharing engines and chassis parts, so those brands would be much more difficult to split.

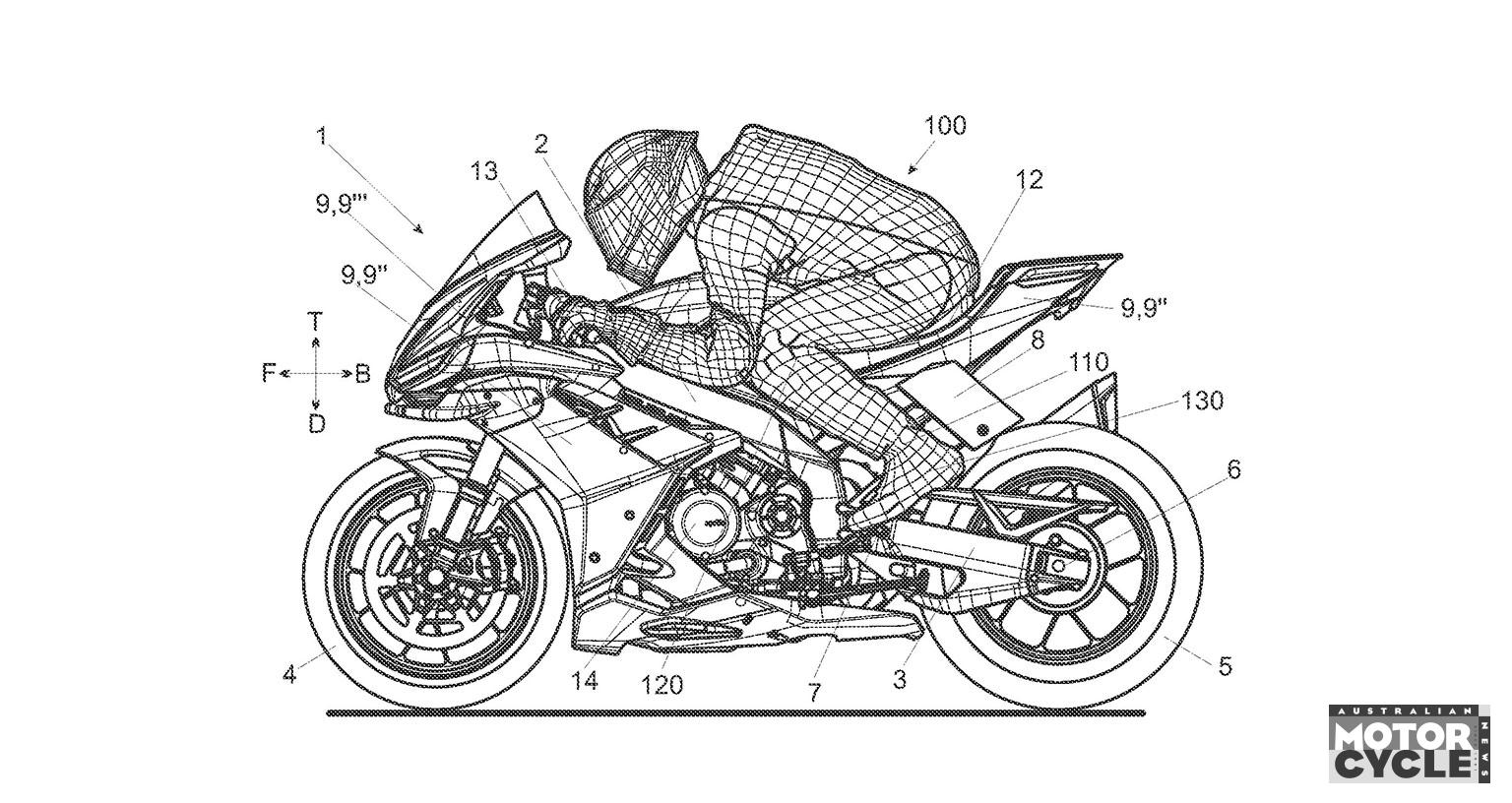

European sources say the insolvency administrator wants KTM to withdrawfrom MotoGP, Moto2 and Moto3, relocate significant production – presumably to China or India – and halt production altogether until the restructuring is approved.

KTM’s involvement in the 2025 MotoGP championships is unlikely to change but the future is hard to predict as the commercial rights to MotoGP are in the process of being sold to US group Liberty Media, which also holds the rights to F1. There’s a potential windfall expected to manufacturers in terms of new investments if the deal goes through, but it’s currently on hold as the European Commission investigates.

KTM is already believed to be in discussions with potential MotoGP investors including bike-mad seven-time F1 champion Lewis Hamilton (pictured above) – previously linked with a potential buyout of the Gresini team. Hamilton is entering the twilight of his career and KTM boss Pit Beirer described the discussions as “concrete talks”.

KTM’s involvement in Moto2 – where its bikes must use a Triumph engine – is more of a marketing exercise but its RC250GP machines make up more than half the 2025 Moto3 grid, meaning a complete withdrawal is hugely problematic. However KTM could continue as a paid supplier of bikes even if it withdraws its works teams. It’s unlikely any changes will happen before 2026.